12

|

Volume 1 Issue 7

CDA

at

W

ork

Volume 1 Issue 7

|

Note:

Dentistsandorthodontistsshouldseektheadviceoftheirtaxprofessionalto

determinehowtheserulesapplytotheirparticularcircumstances.

*Theterms“dentalpractice”orthe“dentist”areusedtogenerallyrefertothepersonresponsible forGST/

HSTregistration,which isona legalpersonbasis– i.e.,asoleproprietorship,partnershiporcorporation.

What is the difference between goods

and services that are tax-exempt versus

zero-rated?

An exempt good or service is not

subject to GST/HST or QST but a zero-

rated good or service is taxable at 0%.

Diagnostic and treatment services

(other than cosmetic services) are

generally tax-exempt, whereas artificial

teeth and orthodontic appliances are

taxable at 0%.

In both tax-exempt and zero-rated

goods and services, the provider does

not collect or report any tax. However,

the distinction is important because

a practice cannot claim ITCs or ITRs to

recover taxes paid by the dentist to

provide tax-exempt goods or services.

On the other hand, a dental practice

providing taxable (including zero-rated)

goods or services may claim ITCs or ITRs

to recover the GST/HST or QST paid on

related costs. (

See Box 2

)

What is the status of the CRA policy

relating to dentists’ and orthodontists’

eligibility to claim ITCs?

The CRA policy relating to dentists’

and orthodontists’ eligibility to claim

ITCs was set out in a letter to the CDA

in May 2004. The policy originated with

the Orthodontics Supplies Agreement,

an administrative agreement from

1998 between the CRA, CDA and the

Canadian Association of Orthodontists.

The 2004 CRA interpretation still

applies. It explains that ITCs may be

claimed for the GST/HST on direct

costs (e.g., taxable laboratory fees) and

eligible indirect or overhead costs (e.g.,

lease of the office and cost of utilities)

to the extent the costs were incurred

for consumption or use in the making

of taxable sales, and provided the

indirect costs are incurred for at least

10% in taxable activities. As a result,

indirect costs must be allocated to

exempt and taxable activities for ITC

and ITR purposes.

CRA’s administrative policy on ITC

eligibility requires that the dentist

or orthodontist patient fees identify

separately charges for taxable sales

(e.g., an artificial tooth or orthodontic

appliance), as distinct from dental

services that are tax-exempt (e.g.,

diagnostic service).

Are there anticipated changes to the

policies onGST/HST andQST for

dentists?

CRA is currently reviewing the

arrangement and CDA is aware of this

situation. CDA provided a submission

to the CRA and will be involved in

discussions with the CRA in regards to

the status of their review. In the interim,

the Orthodontics Supplies Agreement

and the broader CRA administrative

policy relating to dentists’ eligibility

to claim a portion of the GST/HST and

QST they pay on costs continues to

apply. If any changes are introduced,

the CRA has indicated that they will be

introduced on a go-forward basis, not

retroactively.

a

Examples of taxable and

exempt dental services

Tax Exempt

• goods or services covered under a

provincial health care plan

• consultative, diagnostic and

treatment services (excluding services

for cosmetic purposes)

• dental hygienist services (excluding

services made for cosmetic purposes)

Taxable

Standard tax rates

• cosmetic services not for medical or

reconstructive purposes

• the provision of medico-legal reports

to insurance companies or lawyers

• rental of office space or provision of

parking

Zero-rated

• orthodontic appliances, artificial

teeth

• parts, accessories or attachments

specially designed for artificial teeth

or orthodontic appliances

➋

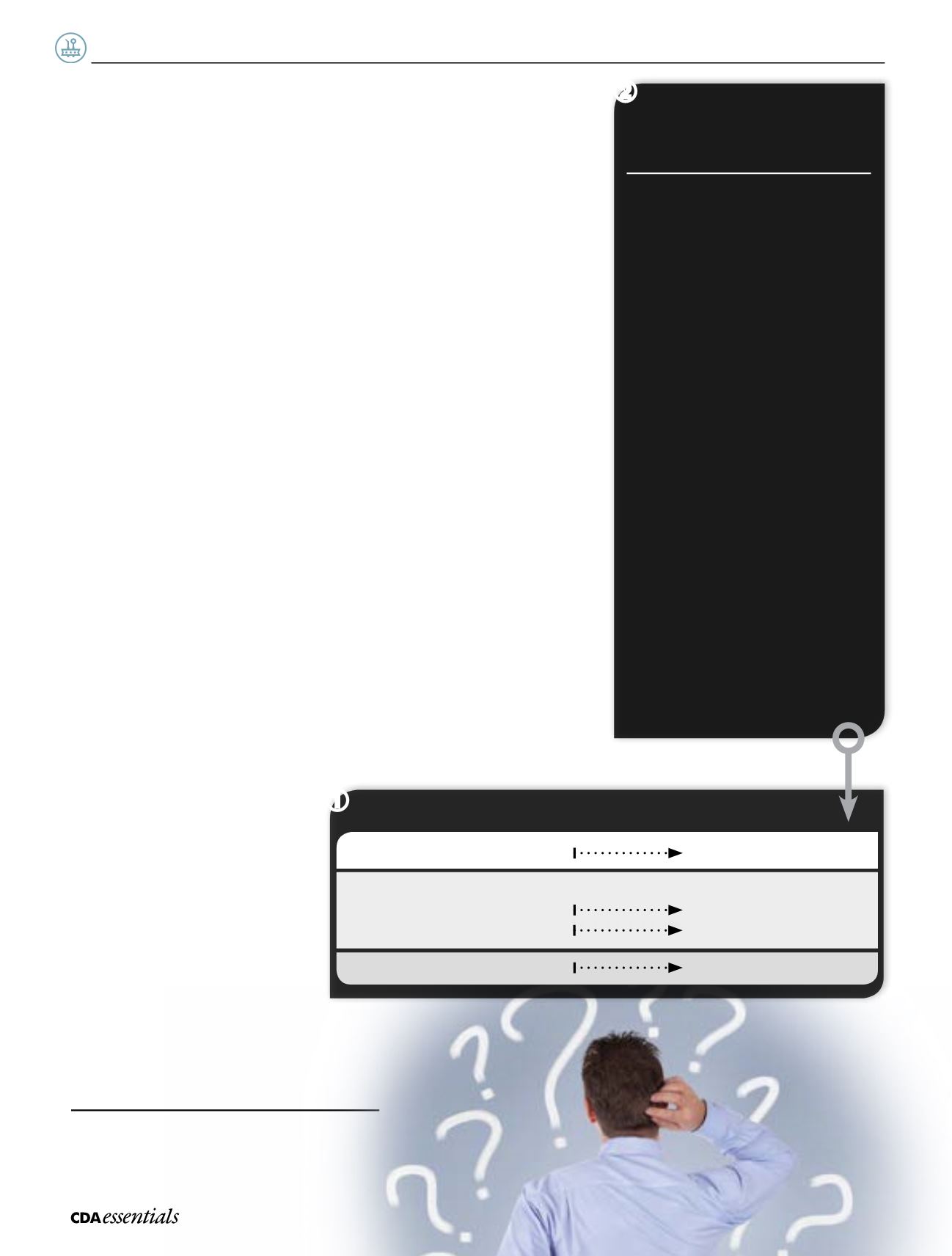

Total taxable supplies

= $0

Cannot Register

Total taxable supplies

> $30,000

Registration Mandatory

Total taxable supplies

< $30,000

i) significant ITCs available?

Register Voluntarily

ii) minimal or no ITCs available?

Do Not Register

To Register or Not To Register?

➊