11

Volume 1 Issue 7

|

CDA

at

W

ork

To better understand

how theGoods and

Services Tax (GST),

theHarmonized

Sales Tax (HST)

andQuebec Sales

Tax (QST) affects

Canadian dentists,

Dr. SuhamAlexander,

CDA clinical editor,

spoke with Rob

Allwright, Associate

Partner at KPMG.

This is a summary of

their discussion, which

includes an update on

the Canada Revenue

Agency (CRA) policy

relating to dentists’

and orthodontists’

eligibility to recover a

portion of their taxes

on eligible expenses.

What do Dental Practices Need to Know About

GST, HSTandQST?

How are dental practices affected by the

GST/HST andQST?

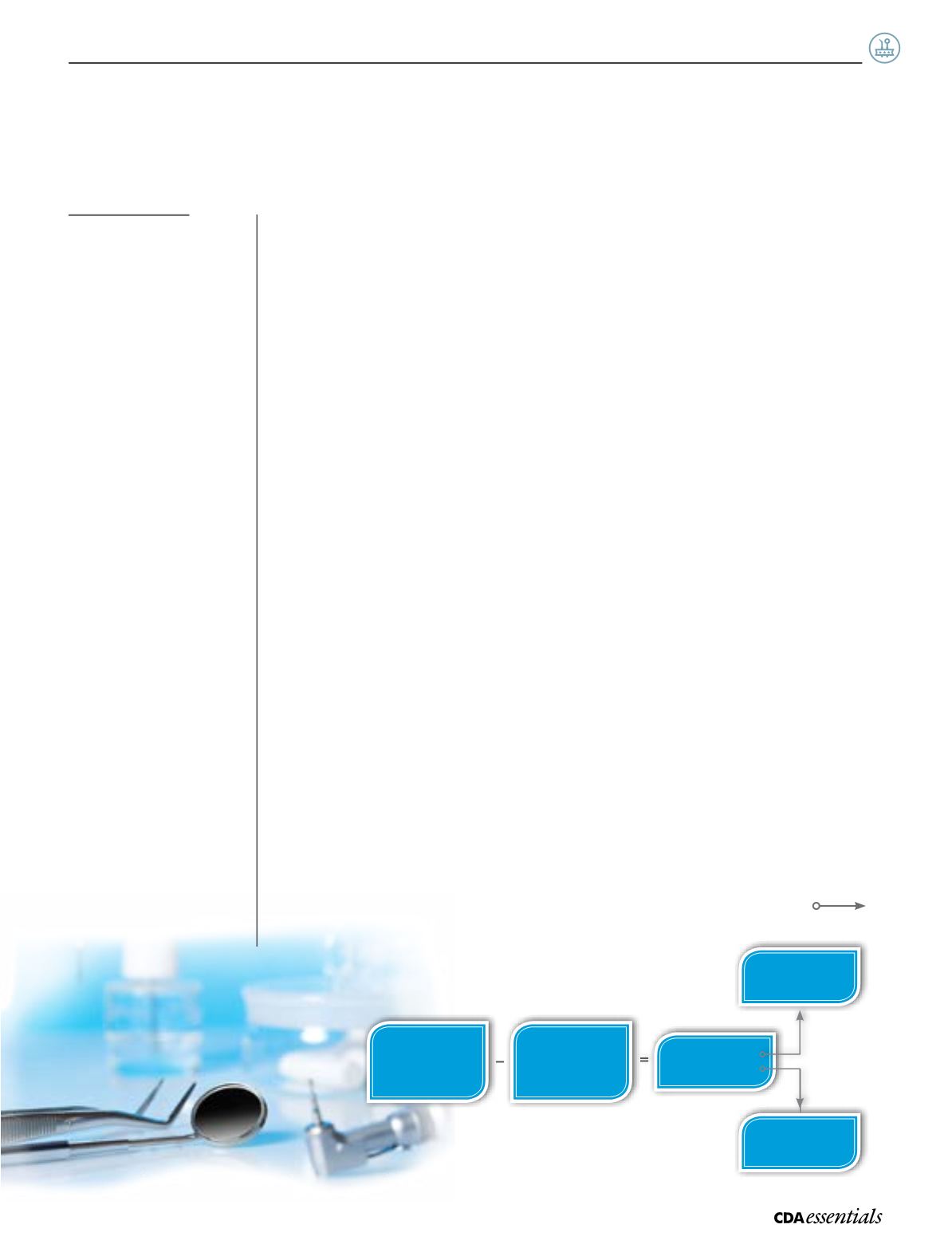

The GST/HST and QST are “value-added

taxes,” which means they are generally

charged and collected by suppliers at each

stage in the production and distribution of

goods and services.

Registered businesses charge and collect

the tax on their “taxable supplies” (e.g., sales

of goods and services) and claim credits for

the GST/HST and QST they pay on expenses

related to their taxable activities. The credits

are referred to as “input tax credits” (ITCs)

in the case of the GST/HST or “input tax

refunds” (ITRs) in the case of the QST. The

difference between the tax collected from

customers and the tax payable to suppliers

is either remitted to the government or is

refunded by the government, depending on

which amount is greater. (

See graphic below

)

Most diagnostic and treatment services

provided by a typical general dental

practice* are exempt from GST/HST and QST.

For tax exempt services, a dental practice is

not entitled to ITCs and ITRs.

However, some dental services are taxable.

For example, services performed for

cosmetic purposes, like teeth whitening, are

taxable. For taxable services, registering for

the GST/HST or QST facilitates the reporting

of tax collected and allows the dentist to

claim ITCs and ITRs for the GST/HST and QST

paid on costs related to these services.

When should a dental practice register for the

GST/HST or QST?

A dental practice is required to register for a

GST/HST account if its total annual revenues

from taxable sales exceed $30,000. Taxable

sales are those subject to GST/HST at the

standard rates of tax as well as sales that

are zero-rated (i.e., subject to tax at the rate

of 0%).

Below the $30,000 taxable sales threshold,

registration is optional. In deciding whether

to register, dentists should consider both

the pros (e.g., recovery of GST/HST or QST

on costs) and cons (e.g., compliance costs

related to filing returns and potential audits

by tax authorities, including a potential audit

if your practice de-registers). (

See Table 1

)

Note that if the practice’s taxable activities

are less than 10% of its total activities, then

the practice may choose not to register

because ITCs and ITRs are not available on

indirect costs.

Registration for the QST in Quebec is

separate from GST/HST registration, but the

rules are generally harmonized with the

GST/HST.

GST/HST

charged to

customers

GST/HST

paid on business

purchases

(+) Owed to

Government

Net GST/HST

(-) Refundable