23

Volume1 Issue4

|

N

ews and

E

vents

If thenumber of dentists isgrowing rap-

idly, thisoverwhelmsgrowth in the total

marketplace, and theaveragepractice

shrinks. Therearevarious factors at play

inBC.

Market growth

BC’s economy isgrowingat aminiscule

1%per year, yet our growth in full-time

equivalent (FTE) dentists isgrowingat

up to3.8%per year. Thepie isgrowing

slowly, but therearemore slicesbeing

cut, hence, thinner slices. Combinedwith

the trendofmaturepractitionersdelaying

retirement (in somecasesby10ormore

years), it suggestsdecliningpopulation to

dentist ratios inBC for thenext decade.

Greater competition

BC isoneof themost competitivemar-

ketplaces inall ofNorthAmerica, not just

Canada.Wehave the lowest “dollar pool”

of all Canadiandentists (

Fig1

)

. If the

increase inFTEs continuesover thenext

10years, aswehave forecast, therewill

beconstant downwardpressureonnet

incomes.

However, there is always a silver lining to

everycloud. The threequartilesof dentists

whoarenot operating like themost efficient quartilehave

theability, throughbettermanagement skills, to runmore

efficiently. Even if thegross incomesof thesepractices con-

tinue todrop theycanmaintainor increase their net income.

Thismeans takingahard lookat expenses. Relyingonwhat

happened in the last 10years tocontinue in thenext 10years

is avery risky strategygoing forward. Thegoodnews is there

aremanyplaces toget themanagement assistanceneeded

to runyour practicemoreefficiently. Onecourse that I am fa-

miliarwith isofferedatUBC

(See:

.

InBC, it looks like thedecreasingpopulation todentist ratio

will persist for thenext 5 to10years, andmanyeconomists

expect slow, uncertainand sluggishgrowth tobe thenew

normal for thenext decade for theeconomiesof theG7

countries, includingCanada.

Spendingondentistry/demand

Per capita spendingondentistry inBC isoneof thehighest,

if not thehighest, inCanada. In2012 therewas adropof

2.6%, representingout of pocket costsor employment

benefits. There isdownwardpressureondental benefits

fromemployerswhichwill further decreaseper capitadental

spendinggoing forward.

0

1000

2000

3000

4000

$0

$10,000

$20,000

$30,000

$40,000

$

$0

$20

$40

$60

$80

$100

b)

PerCapitaDiposable Income

c)

DollarPool ($M) /Dentist

$42.1

$67.3

$51.6

$79.3

$45.6 $48.6

$63.5

$45.5 $49.1

$75.7

$49.2

28,279

36,223

29,485 26,873 28,787

25,851 26,069 26,158 23,970

28,650

26,323

BC

AB

SK

MB

ON

QC

NB

NS

PEI

NL

CA

BC

AB

SK

MB

ON

QC

NB

NS

PEI

NL

CA

BC

AB

SK

MB

ON

QC

NB

NS

PEI

NL

CA

1,490

1,858

2,688

1,920

1,583

1,879

2,435

1,738

2,047

2,875

1,716

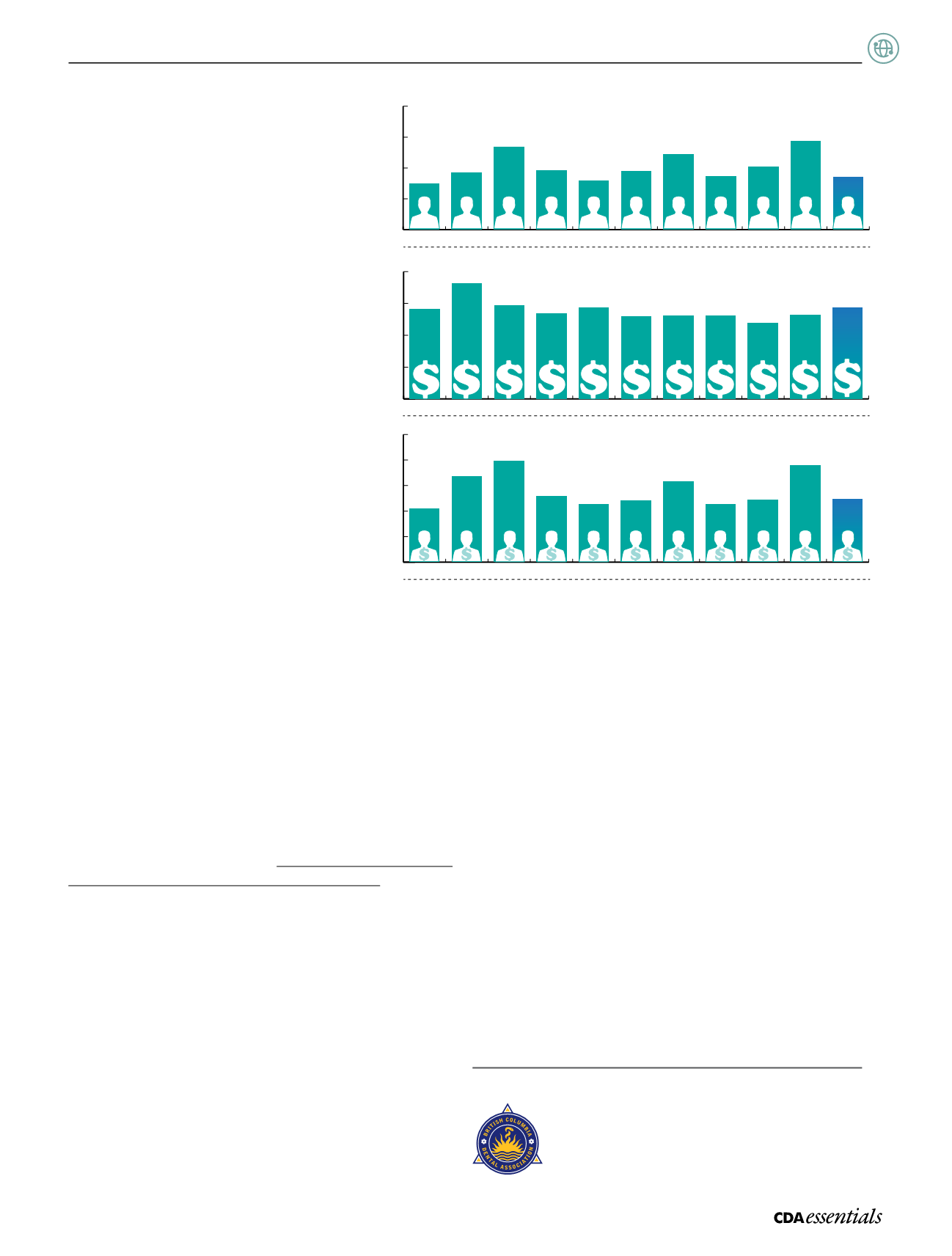

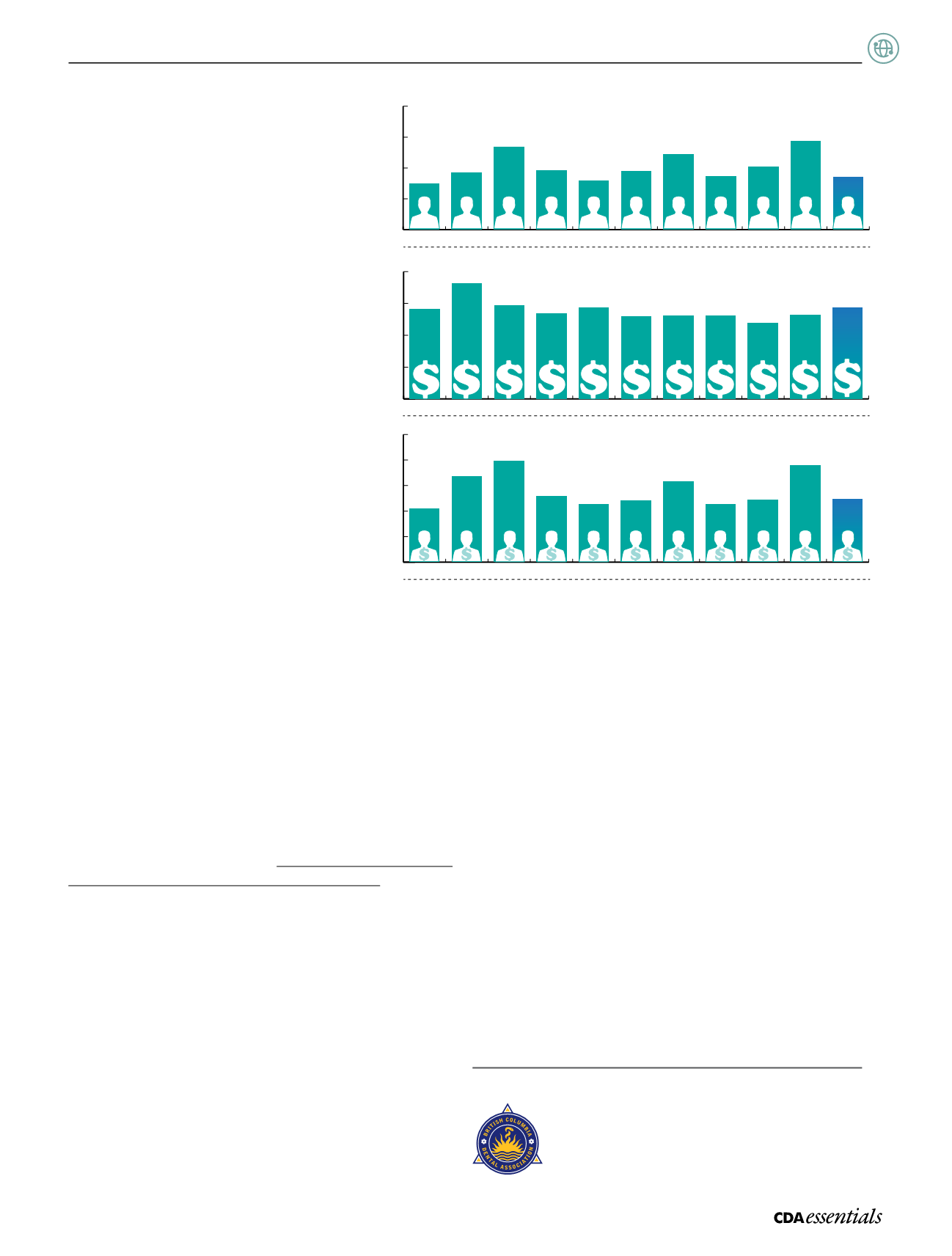

a)

PotentialPatients /Dentist

Figure1: a)

Potential patients per dentist ratios

b)

per capitadisposable income

c)

dollar pool

per dentist ratios.

Sources: RKH Economic Consultants Ltd; Statistics Canada Tables 384-00123 and 051-0001; C

anada

HealthCareProviders, 2000 to2009,

Canadian InstituteofHealth Information,October2011

Ifweare right about stagnating total demand, and stagnat-

ingor decreaseddental incomes theneverydentist needs to

ask someor all of the followingquestions:

• What is a safedebt level tocarrybothpersonallyand in

your practice if it takes longer topaydebt off?

• If youareayoungpractitioner, howmuchdoyouwant

topay for apractice thatmayhavediminishingcashflow

going forward from thehistorical cashflow? Theflip side

question to thematuredentist: howmuchcanyou realisti-

callyexpect fromyour practice sale if thenet present value

(NPV) of your practice isgoing todecrease?Howdoes this

affect your retirement plans?

This articleoutlines themagnitudeof the issues facingeco-

nomics committees acrossCanada. However, dentistry is a

caringand rewardingprofession. Iwishyou thebest in2014,

andhope theworldeconomiesget backon trackagain so

our next column ismore fun towrite!

a