S

upporting

Y

our

P

ractice

38

|

Volume2 Issue8

The Tax Advantages of

CORPORATECLASSFUNDS

I’ll start byassuming that you’remakingwhatever registeredcontributions

areavailable to reduce the taxbiteonyour savings, includingmaximizing

your RRSP, TFSAandRESP investments. After all, as theWall Streetmagnate

MorganStanleyonceproclaimed: “Everymanmust payhis taxes, but you

don’t need to leavea tip.” Beyond registeredoptions, if youhave supple-

mental income that youareable to invest, thereare steps youcan take that

maycreatea taxdeferral benefit using

corporateclass funds

.

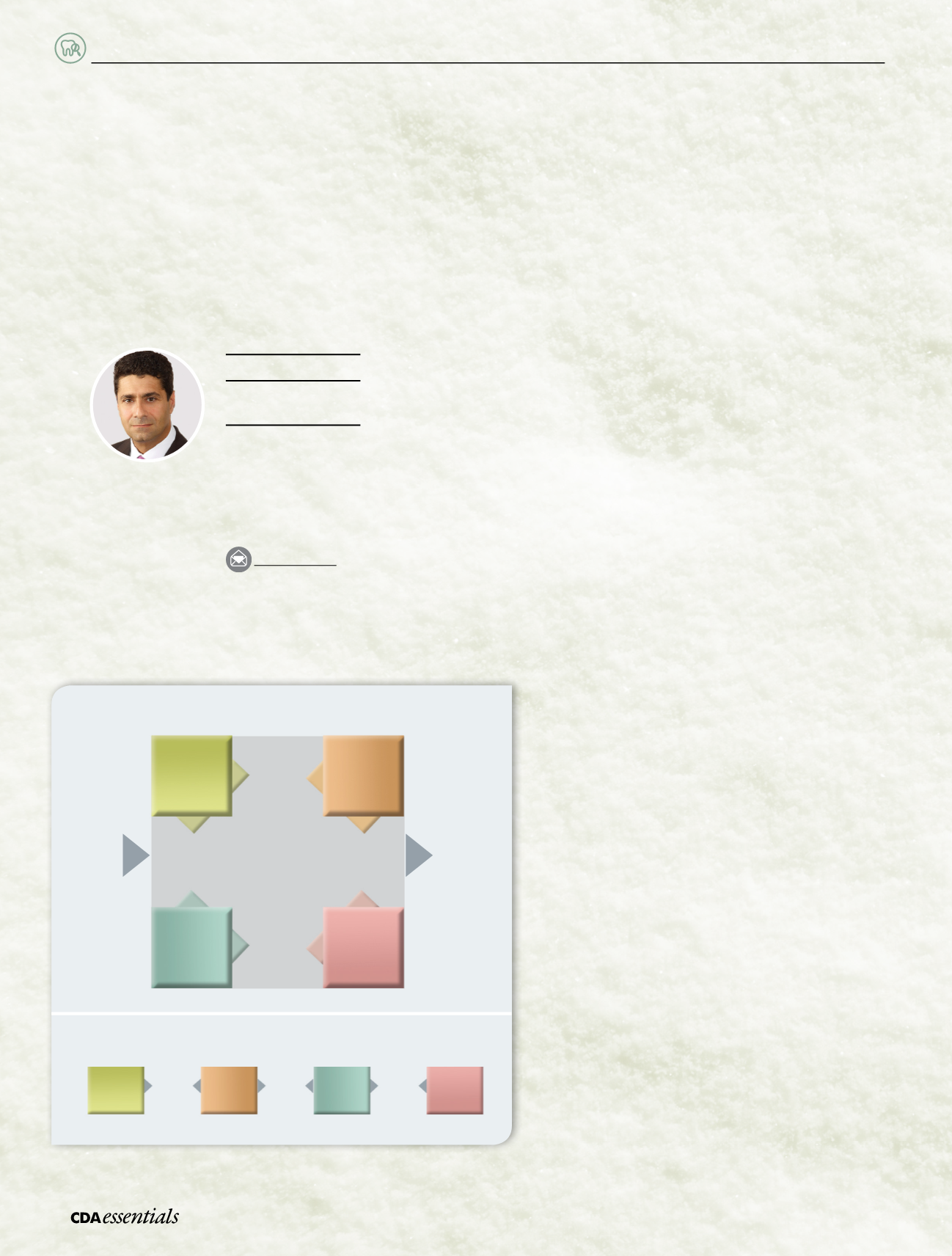

Corporateclass funds are likemutual funds; however, becauseof theway

theyare structured, youcan switchassetsbetweencorporateclass funds

toalignwithyour financial planwithout triggering immediate taxes. That

means as longas you stay investedwithin thecorporateclass fund family,

you’ll defer taxonyour gains.Whenyoueventually redeemout of this class

of funds you’ll pay taxonanygains you realize, but theability todefer tax

for longperiods is avaluablebenefit becausemoreof yourmoney stays

investedandworking for you.

With traditionalmutual funds,whichare structured

as trusts,whenyou switchbetween funds inanon-

registeredaccount, the transaction triggers a

disposition for taxpurposes. The taxes associatedwith

thisdispositionareapplied to that tax year.

Simplyput,

when switchingbetween funds inamutual fund trust,

it triggersapotential taxableevent—when switching

between fundswithinacorporateclass structure, it

doesnot.

Thereare twoways tousecorporateclass funds to

increaseyour savings:

– PersonalAccount

Because theyare segregated funds (i.e., offered

throughan insurancecompany), CDSPI’s corporate

class fundsmayprovideprotection fromcreditors

whencertainconditions aremet. Theyalsoallow

you toprovideanamedbeneficiary so that

expensiveand time-consumingprobatemaybe

bypassedwhen theassetspass toyour family.

EQUITIES

INCOME

BONDS

REALASSETS

BUY

SELL

Triggers

taxable

disposition

SWITCH

Betweenclasseson

tax-deferredbasis

CORPORATECLASSFUNDS

TRADITIONALMUTUALFUNDSTRUCTURE

Taxable

Disposition

Taxable

Disposition

Taxable

Disposition

EQUITIES

BONDS

INCOME

REAL

ASSETS

RonHaik

MBA,CFP®,FMA,

FCSI,CIWM®,TEP

Vice-President,

InvestmentAdvisory

Services,

CDSPIAdvisory

Services Inc.

1-800-561-9401,ext.6859