39

Volume3 Issue6

|

CDSPI isanot-for-profitorganizationwhosemission isto

provideafullrangeoffinancialsolutionsthatmeettheuniqueneeds

oftheCanadiandentalcommunitythroughouttheir lives.Ourmembers

includetheCDAandparticipatingprovincialandterritorialdentalassociations.

Reportswill not show thecompensationpaid to

individual advisors, but rather to the investment

companies theywork for, and theymust alsoprovide

abrief explanationofwhat trailer commissionsare.

Formutual funds, it’sworthnoting thatCRM2

disclosure regulationsonlydealwith theportionof

yourMER that ispaid toyour investmentfirm. Tofind

out about the fundmanagement feesassociatedwith

the fundsyouown, youwould still need tocheck the

productdisclosures for those funds.

•

Theannual reportonperformance.

This isdesigned

togive investorsabetterunderstandingof their

personal rateof returnafter costshavebeen

deducted. Itprovides results for your full account,

whichmay include individual equities, bonds,

mutual funds, or cash. The reportmust show, in

percentagesandactual dollars, themarket valueat

thebeginningof theyear, deposits,withdrawals,

dividends, anychange inmarket value, and the

closingbalanceat theendof theyear. Itwill also show

your compounded, annualized rateof return from

the timeyouoriginallyopened theaccountwith the

institution, aswell asyour returns for thepast 3, 5, and

10years if that information isavailable.

Thepurposeof thisarticle is toprovideabrief overviewof

thenew reporting requirements. For further explanation

of all theparticularsofphase threeofCRM2,we suggest

that you speak toyourfinancial advisoror investment

firm.

a

Advisoryservicesareprovidedby licensedadvisorsatCDSPIAdvisoryServices Inc. Information

in thisarticle is for informationalpurposesonlyand isnot intended toprovidefinancial, legal,

accountingor taxadvice.Restrictions toadvisoryservicesmayapply incertain jurisdictions.

IfYouHoldCDSPIFunds

SinceCDSPI Funds are segregated funds,whichare regulated

by the insurance industry, CRM2 requirementsdonot apply to

them. That being said, your Investment PlanningAdvisor can

provide similar information to that requiredbyCRM2at your

request.

It’s important topoint out thatCDSPI fundsdonot charge

trailer fees, and thereareno front-endor back-end “loads”

(commissions)whenbuyingor sellinga fund.

Sinceadvisors

fromCDSPIAdvisoryServices Inc. donotworkon

commission, theycanbeobjectiveabout the investments

they recommend.

Their financial planningadvice isofferedas

amember benefit of theCDAandparticipatingprovincial and

territorial dental associations.

Abenefit of our structure is thatweareable to leverage the

buyingpower of thedental community tonegotiate lower

fees,whichhelps lower theMERs for our funds.WhileMERs

for funds inCanadacan reachashighas 3%ormore, the

averageMER for CDSPI funds is 1.26%.

2

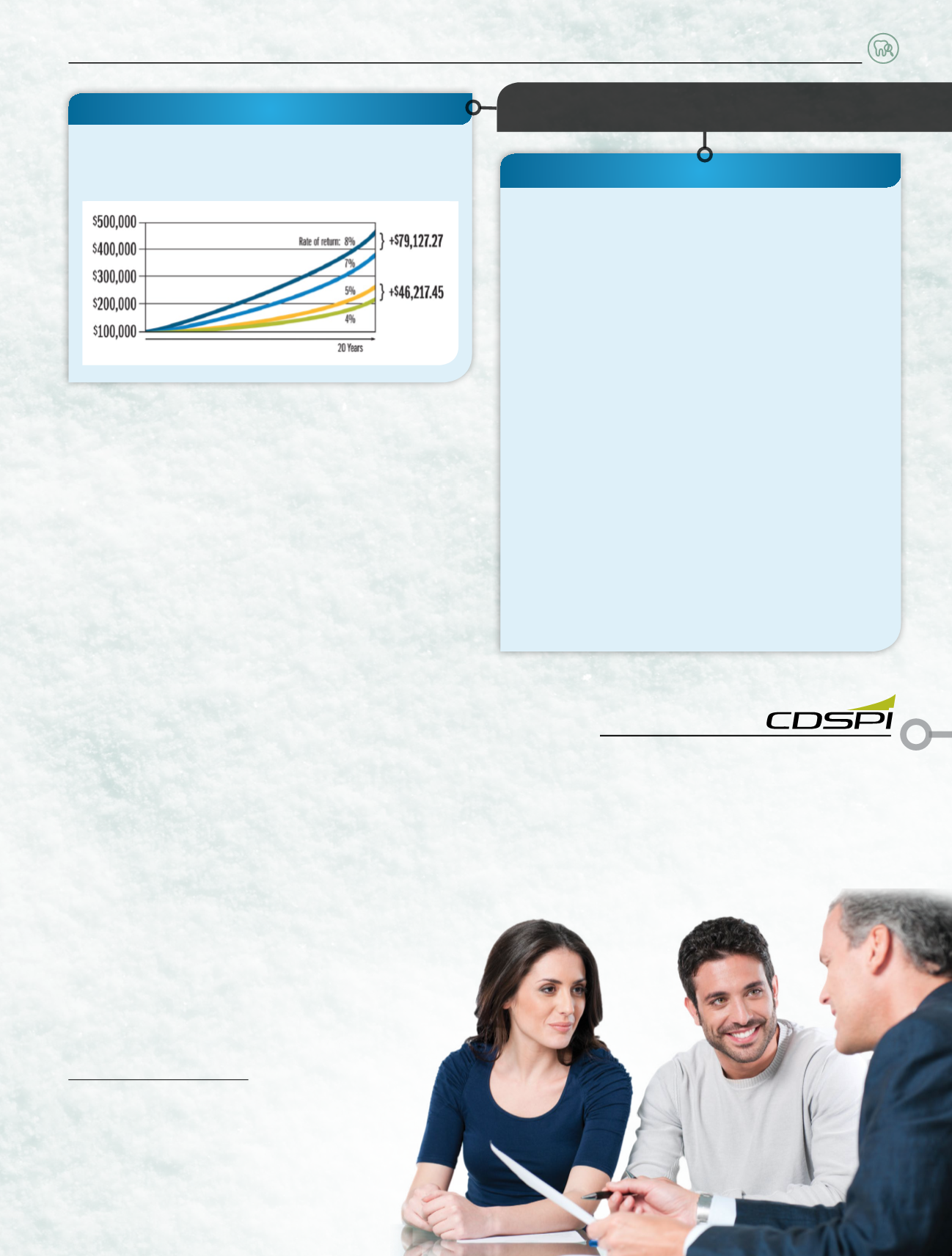

As youcan see from

theaccompanyingchart, it’s important toconsider fees inany

investment decision.

If youwould like to learnmoreabout theadvantagesof

investingwithCDSPI Funds, I inviteyou tocontact us at

1-800-561-9401

or sendanemail to

DoFeesMakeaDifference?

Yoube the judge. This chart shows twoexamplesof the

incremental returns youwouldachievewitha1% feeadvantage

onan investment of $100,000over 20years.

1.Source:

BusinessNewsNetwork

,2015

2.Management feesaresubjecttoapplicabletaxes.

S

upporting

Y

our

P

ractice