41

Volume3 Issue2

|

Ways toTailor Insurance Premiums

S

upporting

Y

our

P

ractice

Aswith life insurance, youcanbenefit frompremium

reductions if yourhealthy lifestylequalifiesyou for

HealthEdge rates. (

Table

➌

)

OfficeOverheadExpense (OOE)

If youareunable topractise for severalmonthsor

longerdue toan injuryor illness,OOE Insurance

can reimburseoverheadexpenses suchas rent,

equipment leases, utilities, staff salariesandmuch

more. Youcancustomizeyourmonthlybenefit and

premiumsbasedon:

1) yourongoingeligibleexpenses;

2) thewaiting timebeforebenefitsbegin (14or 30

days);

3) themaximum lengthof timeyoumay receive

benefits (12or 24months); and

4) afixedor reducing scheduleofpayments. (A

fixedplanprovidesup to100%of yourmonthly

benefit for the full lengthof your claim,whilea

reducingplan startsat 100%and reducesby set

percentagesat specific intervals.) (

Table

➍

)

TripleGuard™ Insurance

TheTripleGuard™ Insuranceplanprovidesoffice

contents, practice interruptionandcommercial

general liabilitycoverage for completeprotection

of youroffice. It’s important that youkeepyour

coverageadequate for thevalueof youroffice,

particularlyasyou renovate, expand, or addnew

equipment. If youown thebuildingyoupractise

in, youareeligible for a10% reductiononyour

TripleGuard™ Insurancepremiumwhenyouadd

Building Insurance.

HomeandAuto

By representing the interestsof thousandsof

dentists, their staffand familymembers, CDSPI

isable toprovidepreferred rates for thedental

community. These rates canbe further reduced

whenyoupurchasebothhomeandautocoverage,

or coverage formore thanonevehicle. Andyou’ll

savewhenyououtfit your vehiclewith fourwinter

tires, or equipyourhomewithacentrallymonitored

alarm system.

Theseexamplesprovidea startingpoint for a

comparisonofplanvariables. (Full rate tables canbe

foundunder the Insurance tabat

cdspi.com

) Tofind

outhowyoucanadjust existingpoliciesaccording to

your current circumstances, or acquirecompetitively

pricedplans for theprotection that isappropriate for

you,we inviteyou to speak toan insuranceprofessional

atCDSPIAdvisoryServices Inc.

a

All ratesquoted in thisarticleare for yourgeneral guidanceandareexclusiveof taxes. Youcan learnmoreabout

precisedetails, termsandconditions (including restrictionsandexclusions) fromanadvisorwithCDSPIAdvisory

Services Inc. Restrictions toadvisory servicesmayapply incertain jurisdictions.

• BasicLife,AD&D, LTDandOOE InsuranceunderwrittenbyTheManufacturersLife InsuranceCompany (Manulife).

• TripleGuard™ InsuranceunderwrittenbyAviva InsuranceCompanyof Canada.

• Home&Auto InsuranceunderwrittenbyThePersonal InsuranceCompany. ThisAuto Insurance isnot available

to residentsofQuebec,Manitoba, SaskatchewanandBritishColumbia. ThisHome Insurance isnot available to

residentsofQuebec.

CDSPIprovidestheCanadianDentists’InsuranceProgramand

theCanadianDentists’InvestmentProgramasmemberbenefitsofCDA

andotherparticipatingprovincialandterritorialdentalassociations

.

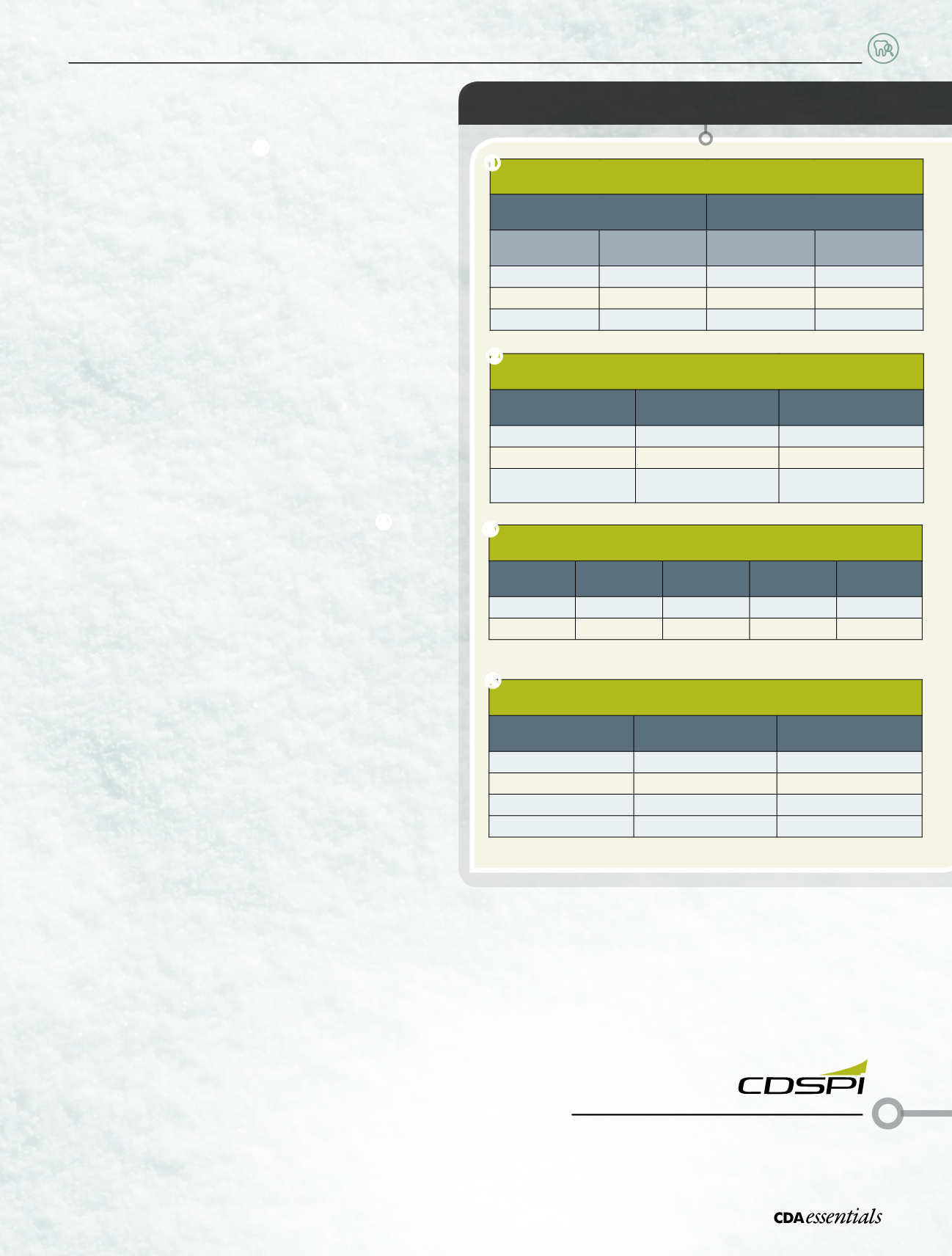

Yearly premiums for a 30-year-old female non-smoker earning $150,000,

with amaximum benefit of $6,400 per month*

Elimination

Period

30Days

60Days

90Days

120Days

Basic

$3445.76

$2549.76

$1953.92

$1774.08

HealthEdge

$2730.88

$2019.84

$1547.52

$1406.08

* Premiums include theOwnOccupation, Cost of Living Adjustment, and Future Insurance GuaranteeOptions.

➌

Yearly premiums for a $10,000 per month benefit,

for a 45-year-old female non-smoker who qualifies for HealthEdge rates.*

Elimination Period

14Days

30Days

12Mo. (fixed payments)

$1774

$1330

12Mo. (reducing payments)

$1532

$1132

24Mo. (fixed payments)

$2517

$1940

24Mo. (reducing payments)

$1887

$1406

➍

Comparison of Basic Life andAD&D yearly premiums for a 42-year-old non-smoker

Coverage amount

Basic Life

(Basic Rate)

AD&D

$100,000

$139.84

$ 40.80

$300,000

$419.52

$122.40

$500,000

$664.24

(With 5% reduction)

$204.00

➋

Premium reduction opportunities for Basic Life

CoverageAmount

PremiumReduction Benefit (%)

by Rate Category

From

To

AdvantEdge

HealthEdge and

Basic Rates

$500,000

$975,000

15%

5%

$1,000,000

$1,475,000

25%

10%

$1,500,000

$2,000,000

27.5%

15%

➊

* Premiums include theOwnOccupation and Future Insurance GuaranteeOptions.